Whenever the stock market drops, even a tiny bit, everyone goes crazy. The news headlines always state a reason for the drop, whether their reason was the culprit or not. They imply one specific thing that happened in the world is responsible for the downturn. “Crisis on Wall Street as Lehman Totters,” “Worry about oil prices send stocks plummeting,” or “As Middle East talks stall, the market falls.” The headlines never read “Stocks down 3% due to more people wanted to sell than buy today.”

Recently we had a drop in the stock market and again everyone is asking what to do. Do we sell? Do we buy? This time the headlines read the pandemic is the cause of the decline. With so many businesses shut down, it is not a surprise to see the market drop. This time everyone can relate to why the market has dropped.

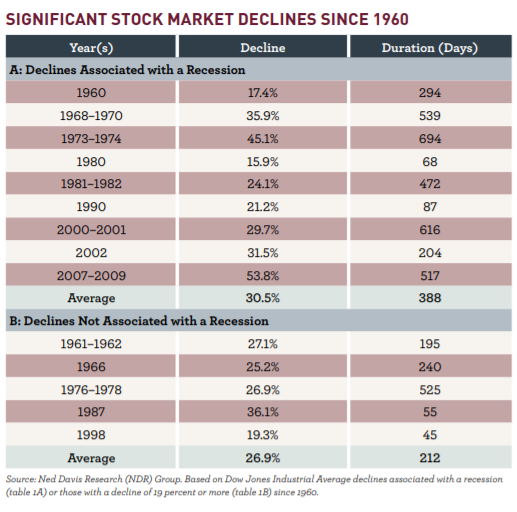

The recent March drop in the Dow Jones Industrial Average was about 38% and about half of that has already recovered. So how does that compare with other drops? The chart below is taken from an article by Ricardo L. Cortez, CIMA, called A Look at Bear Markets from 1960 to the Present and was published in the Investments and Wealth Monitor in March of 2018. The listed declines were only those associated with a recession or those of 19% or greater. Although lesser declines happened during this period, only the big ones were listed here.

You can see from the chart that the average drop in the Dow was about 29%. Of the fourteen drops they listed, four were about the same or larger than the one we just experienced. So the current drop isn’t anything out of the ordinary. This is the fifteenth drop listed in 60 years, so we are averaging a big drop every four years. Since we haven’t had a major drop in over a decade, we were overdue for one even without the Coronavirus coming along to mess up our thriving economy.

With each market drop many people standing around the water cooler are saying that this time is different. Well since we haven’t had a pandemic for over a hundred years, this time they might actually be right. But does that matter? So what if it is different this time? What is actually different? No one knows.

I learned long ago to invest for the long term and ignore all these little blips that happen every few years. If you are investing for the long haul, you expect drops to happen. It is part of the normal process of supply and demand.

When I was younger, I thought I could pick stock winners. Turns out I didn’t have that superpower. Whenever I tried to time the market, I got lower returns than if I would have just left the money alone and let it grow.

Market studies have consistently found that only about 20% of the stock picking gurus are able to beat the market in any given year. Next year it will be a different 20%. None of the experts are able to consistently do what all of us lay people think we can do. Turns out they don’t have the stock picking superpower either.

If no one has the ability to time the market, what should we do? We should listen to the evidence and stop trying to time the market. Buy stocks only for the long haul.

When I was young and thought I was a better stock picker than everyone else, I watched the market daily. I read a lot of articles about the latest trends. I spent a lot of my precious time futzing around with the stock market.

Now I am older and I spend about zero hours following the market. I learned long ago that following the market is just a waste of time. I still hear about market drops, because so many other people talk about them. But I don’t do a thing about it. I don’t make any investment decisions based on the current stock market situation. I base all my investing decisions on long term goals.

My usual holding period is forever. I still own the first mutual fund I bought when I started my IRA in 1989. I record the total value of each of my retirement accounts on a quarterly basis, but I do not record the total value of any single mutual fund I own. I don’t even look at the returns on any of my mutual funds. I still end up with results that mirror the general stock market returns. That beats 80% of all the investment advisors out there.

If I can beat 80% of the advisors by doing nothing, then why would I waste anytime following the market? It is a lot like getting a chest x-ray every day to see if I’m still healthy.

I would encourage you to invest for the long term in index or low cost no load mutual funds. Then let them ride. Ignore the ups and downs and enjoy the added time benefit you gain by spending more time with your family. By following this method you will likely get better results than your friends who think they have the super power of market timing.