This weekend we celebrate Father’s Day. Fathers have the ability to provide great advantages for their children, who arrive in this world totally dependent on their parents. I appreciate all the things my father did for me and wrote about six lessons I learned from my dad in a previous father’s day message.

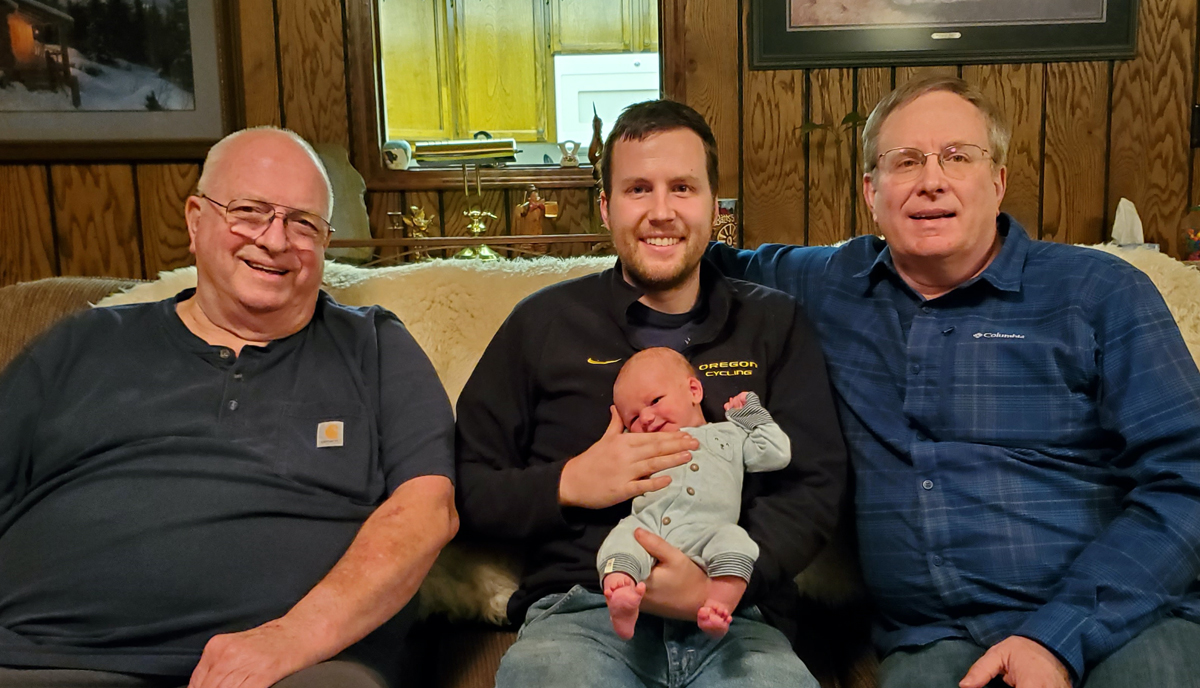

A few months ago, my oldest son had his first child, so this year he will be celebrating his first Father’s Day as a father. When he brought his son over to meet us for the first time, only a few days old, you could see the pride and joy in the new father’s face. It reminded me of the scene in The Lion King where Simba was held up for everyone to see. It was an emotional moment. The picture with this article is the four generations of Fawcett men.

As I held my first grandchild in my arms, I began to think of the things my son would need to know as his life changed from that of a husband to the even more demanding role of a father.

When that third person joins the family, it triggers a few changes in one’s life. Following is a list of some things every new father should do at this important juncture in his life.

1: Update your will.

Sadly, most new fathers don’t yet have a will, so they should create one at this time. For those who already have a will, there are two very important things that need to be added. The first is to add your new child to the list of those who are in line to inherit your estate in the event of your death.

None of us like to think we might die, but every day, a few young fathers pass away unexpectedly. Life for those you leave behind will be less stressful if you die with a will. The will should state that everything goes to your wife when you die and in the event she is not living, then it goes to your child.

The other thing you should specify is who will be the guardian of your new child if both parents are gone. When I do a financial makeover with my coaching clients, setting up a will is an important part of transforming their financial lives. Many parents do not want to make a will because they cannot decide who should raise their children if they die. Who better to make this hard decision than the parents? If both parents die without a will the court will decide who will raise your children. So don’t delay adding a guardian to your will.

Recently, I had a narrow escape, as I saw a large truck in the process of running a red light, barreling down on my car door to T-bone me. Only my quick swerve and his breaks prevented my will from being read. As I drove away, I was reminded of how quickly my life could end without warning. I can still picture my close up view of the Ford emblem on his front grill. More than half of all American adults do not have a will. Put yourself in the other half.

2: Add your child to your health insurance

You would think this is automatic when you add a new member to your family, but some policies are only for a single insured member. If you do not add the child to a policy, and pay the additional premium, your child might not be covered. You don’t want to find yourself in the emergency department of the hospital only to discover your child is not on the policy.

3: It’s time for term life insurance

If you haven’t purchased life insurance yet, maybe because both spouses were working and could take care of themselves in the event of the death of the other, now is the time to get term life insurance. You now have someone depending on you to care for them financially. If you were to die, you don’t want to leave them destitute. Buy a 20-30 year level term policy. If you are not sure how much coverage to get, this article will help.

If you already have a life insurance policy, then you now need to update the beneficiaries to include your new child. Your primary beneficiary should be your wife, and the secondary beneficiary would be your child. You also need to be sure the policy is big enough to meet the changing needs as your family grows over time.

4: Be sure you have enough disability insurance

If you don’t have any disability insurance, now is the time to get some. Your child is depending on your income to survive. If you become disabled, they will suffer as well. You should have a policy that will pay if you cannot perform your current occupation.

If you have a policy that you bought a while back make sure you have enough coverage.

5: Update beneficiaries on all your accounts

Almost every investment account you own will request a list of beneficiaries. It is very likely that you only have your wife listed as the beneficiary. Now you can add your child as a secondary beneficiary in case your wife were to die before or at the same time as you.

This is a place where things get missed. There are often many accounts that need updating and you want to be sure you change all of them. Checking and savings accounts, certificates of deposit, retirement plans, IRAs, deferred compensation plans, brokerages accounts, insurance accounts, businesses, and anything else you can think of needs to be updated.

6: Beef up your emergency fund

If you have established an emergency fund as six months of your living expenses, don’t forget that those living expenses just went up. Figure out what your new budget will look like and how much extra you will need to put in the emergency fund to bring it in line with your new six month expense number.

You don’t want to fall short in the event of a job loss or any other black swan that comes along to throw a wrench in your plans.

7: Save adequately for your retirement

It is your job to take care of the financial needs of your child, not the other way around. You don’t want to become a financial burden to your child when you are in your retirement years. However, there is a good chance your child will need to help you as you age, become weaker, lose your balance, or can’t remember things anymore. After all, you helped them with these things when they needed it.

Please don’t spend all your money while earning a living so nothing is left for retirement. Your child should be able to help you use your own money to take care of your retirement years. They should not have to dip into their finances to pay your bills. Make sure you can stand on your own financially for the rest of your life.

8: Start saving for their college

Giving your child a debt free education is such a great blessing. Many people get strapped with student debt these days making it very hard to dig their way out as they begin their career. Blessing your children with a savings account for their college education is such a great gift.

I was very proud to have both of my sons be able to get their bachelor degrees without having the burden of debt hanging over them. There are a lot of doctors who earned a lot more than I who were unable to give their kids this head start on their financial future.

9: Plan to be a big part of their life

Physicians have a tough work schedule. I was a resident when my first child was born and I would often go days without even seeing him. It is hard to develop a relationship with someone you never see. Make it a point to prioritize your children in your life.

My wife and I have been taking care of our grandson 1 ½ days a week and have really enjoyed our time together getting to know each other. It brightens my day when he sees me and smiles.

To all you new fathers, like my son, who are celebrating their first father’s day, I wish you a HAPPY FATHER’S DAY. Take care of the new details in your life and do your best to raise a happy, well rounded, and responsible adult. That is one of the greatest joys in life.