As the year comes to an end, congress has passed the new tax bill. This was certainly not tax reform as has been discussed, but simply a rearrangement of how they calculate our taxes. This new plan lowers tax rates but eliminates many of the items that were previously deductible. Sort of like rearranging the deck chairs of the titanic as it slowly sinks. Real tax reform might have made things so much simpler that the IRS would be able to lay off 75% of their staff, or the number of tax forms used for my personal taxes would go down to a half dozen instead of 50.

Cutting through all the baloney we see on TV and the internet, what is the real effect of this new tax plan? What are the changes that will affect us? For the majority of physicians, I suspect there will be little change.

So what is new that is important to an average practicing physician:

1: All the tax brackets are now paying a lower percentage of their income to taxes. This is good, but this will be offset by some deductions you will likely lose. So don’t spend the money yet.

2: The deductions for yourself and your dependents will be lost (personal exemptions). This is $4,150 in 2017 for each dependent, so larger families will feel this loss the most. This will increase your taxable income.

3: To make up for #2, a child tax credit will be increased to $2,000. This will be good for big families and this directly decreases the tax bill dollar for dollar, if your dependents are under age 17 and you earn under $400,000 if married, $200,000 if single. The tax credit will only counteract the loss of the personal exemption of your children, not of you and your spouse. Big families will benefit, small ones will not.

4: The standard deduction will increase to $24,000 for a married couple, $12,000 if you are single. This will create a situation where an estimated 94% of taxpayers will no longer benefit from itemizing their deductions. That means, for most of America, your mortgage interest and charitable giving will not be deductible at all. A physician with a combination of substantial gifts to charity, paying high state taxes and maintaining a home mortgage, will likely still be doing itemized deductions.

5: State taxes as an itemized deduction will be limited to $10,000. Just take a look at your last Schedule A and see if this affects you.

6: If you pay alimony, it will no longer be deductible. If you receive alimony, it will not be taxed.

7: Mortgage interest will only be deductible for the first $750,000 of the mortgage.

8: Interest on a home equity line of credit will no longer be deductible.

9: 529 college savings plans can now be used for K-12 private schooling. This might help your current year’s budget, but taking the college money out to spend on your 6th grader is not wise. This money has been set aside to spread the college expense over many years because college is expensive. Be careful to not fall into the trap of using the money previously saved for college on K-12 private schooling. Overspending on private K-12 is a big problem for a lot of doctors I counsel. They often do not have the money to pay for private school, but are steadfast in their determination to keep their kids in private school. This new rule will hurt us in the long run if we use the money we have been saving for our kids’ college on today’s bills

10: The penalty for not having health insurance will be lifted. Most doctors have insurance and do not pay this penalty, but this effect will be felt by an increasing number of your patients not being insured. If everyone is not required to have insurance, and insurance companies must pay for pre-existing diseases, premium costs will rise. They are already too high. This rule will hurt your bottom line in two places, higher insurance premium costs and more uninsured patients.

11: Estate tax exemption will move up to $11,000,000 for each person. Most doctors will never have an estate this large so this effectively eliminates your federal estate tax worries. The problem is this number is constantly changed by congress. By the time you die, who knows what the rule will be.

At almost 500 pages in length, the new tax plan has many more rule changes I didn’t discuss, but the changes listed above are the ones most likely to affect the average doctor. The pass through business changes may also be very helpful to those who own their own medical practice.

I applied the above tax changes to my 2016 tax returns. This is the easiest way to see how these rules effect your taxes.

For me, in 2016 I paid $19,837 in federal income tax. With the new rules, I will lose my personal exemptions. For 2016 that was $12,150 for me, my wife and one son still at home. I will also lose $14,850 in state income and property tax deductions that exceeded the new cap of $10,000. Those two lost deductions, $12,150 + $14,850, increased my taxable income by $27,000.

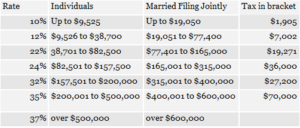

Using the new tax chart below, my 2016 federal tax would be increased to $23,339.

I will not get the new child tax credit, because my son is not under age 17. This credit was supposed to offset the loss of the personal exemptions deduction.

I will be getting a tax increase under the new plan. My 2016 federal taxes were $19,837. When I lose the $27,000 of deductions, and my taxable income increases by $27,000, the new lower tax brackets will not be low enough to compensate for the loss of deductions. Under the new tax plan, my 2016 taxes would increase by $3,502 on a physician’s income that is right at the national average for all specialties.

You should take a look at your 2016 tax return and see what will change for you. Changing only a few numbers on form 1040 and Schedule A will allow you to see what happens to your personal income taxes.

To calculate what your 2016 taxes would have been using this new tax plan, take the taxable income figure on line 43 of form 1040 that you have now recalculated with the new changes. Find the bracket in the chart above that matches your new taxable income. You will pay that bracket’s percentage of the income that exceeds the lower limit of the bracket. You will add that to the totals for each bracket above it.

For example, if your newly calculated taxable income on line 43 is $200,000, you would be in the 24% bracket. So you will pay on the income that exceeds $165,001 which is $34,999. 24% of $34,999 is $8,400. Since you also owe the money in the brackets above, your total tax would be $1,905 + $7,002 + $19,271 + $8,400 = $36,578.

If you will be getting a tax break, be sure to make changes in your payroll deductions so you can take advantage of the windfall throughout the year and not just when you file your taxes in April of 2019.

I’d like to take a poll. Tell us what you found when you did these calculations on your 2016 taxes. Will you be getting a tax break or will you be paying more taxes?

I hope your results make for a Happy New Year.

Hmm if I’m doing this right it looks like I would be paying $4,700 less in taxes with the new tax plan. Swapping out 2 exemptions ($8,100) and taking the increased $24,000 standard deduction, since we don’t itemize.

We are considering being first time homeowners soon, so let me know if I’m thinking about this right… If we buy a $250,000 home with a 4% 30 year mortgage, we would end up paying $10,000 in interest (usually upfront before principle?) We still wouldn’t end up itemizing with the old tax plan since the standard deduction for married couples is more than the mortgage interest, right? I thought buying a home usually meant a tax break somewhere or am I missing something? Thanks!

You are right. But mortgage isn’t your only deduction. State income and property taxes and donations to charity also count. What ever exceeds $24,000 will be deductable. Mortgage interest has never been a good deduction and the new tax law just made it worse. Most Americans do not get a deduction for their mortgage, they just think they do. I covered this problem extensively in my book The Doctors Guide to Eliminating Debt.

Oh I see! Thanks for the clarification. Wild that so many people would be thinking they get a deduction that they’re actually not. Well, I guess not too wild

One of the great tax code deceptions.

A great overview. A minor correction to your point 2 you may want to correct with an update. My IRS Form 1040-ES instructions states the 2017 personal exemptions as $4,050 per person, not $4,150.

Great overview. It’s fascinating to see how everyone is affected differently. There are definitely winners and losers.

Did you not pay the AMT before? I always did, so I’m not losing deductions on state income tax or property tax. I am, however, picking up $4,000 in tax credits for my two boys for the first time ever. I expect to have $8,000 to $10,000 in tax savings compared to the old tax code.

Best,

-PoF

There will be big differences from family to family. That is why I suggested people plug in some numbers in their own 2016 tax return to see how the new plan will change things for them. I was disappointed to see they didn’t just make a tax cut for all, such as just lowering the rates in each bracket. When they lower some things and raise other it makes it more difficult to see the actual effect. A bit of smoke and mirrors.