I recently was asked about taking a low or no interest car loan and using the money they had earmarked for a car to instead invest for a higher return. This “I can get a better return” game is very common and can be a dangerous game to play. Often it is used as a disguise to camouflage buying a car you actually can’t afford, while trying to sound like you are making a great business deal.

Before you play this game, there are three things to consider.

1: Can you actually afford the car? Being able to afford the car means you have enough money to write a check for the full price without becoming strapped for cash. This is not a valid use of your emergency fund, as a new car purchase is not an emergency, but is something you should be planning for. If you actually have the money, then it is possible to play this game. If you don’t have the money, you are kidding yourself trying to justify the purchase and are not actually able to play the game.

In order to play this game, you must take the money you would have spent on the car and invest it for a higher return. That implies you actually have the money.

2: If you take the low/no interest loan, can your spending plan handle the extra payment? Your monthly expenses will go up when you make this move. Your insurance premiums will also increase. If you are living on the edge of your income already, you cannot afford to have your monthly expenses go up and the car payments/insurance premiums will become a problem. If you are not yet debt free, this extra payment will be cutting into your ability to pay off your other debts.

One of my tenants experienced this cash flow problem first hand. He inherited some money after his grandmother’s death. He used his inheritance to buy an additional car, which he didn’t need. The increased monthly expense put him over his budget and he did not have the money to pay his rent. He ended up losing his apartment because he could no longer afford the rent. He was worse off after inheriting money, because the move he made increased his monthly expenses beyond what his cash flow could cover.

3: You must actually invest the money and get a higher return. If you have no place to put the money, you are not actually playing the game, you are just making excuses to buy the new car with a loan. If you actually invest the money, you should realize a greater total return. You must take into account the other issues in the calculations that most people leave out. Will you pay taxes on the investment return? If so, then reduce the effectiveness of the move accordingly. Will you lose a cash discount if you take the low/no interest loan? If so, you must calculate the loss of discount into the return. Often the cash discount will negate any interest differential you might achieve by playing this game.

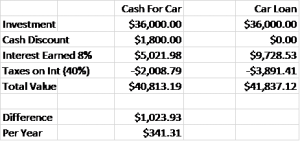

Here is an example. Let’s use a $36,000 car offered at 0% financing over 3 years. If you were to offer cash instead of taking the loan, they would give you a 5% discount, or $1,800 off the price. The payments on the loan will be $1,000 a month for 36 months. You would like to take the 0% financing and use your $36,000 of cash to invest in something you think will give an 8% return.

Most people think of this as earning the interest difference of 8% on the $36,000 over three years. But that is not how the math works. If you invest the money instead of paying off the car, you will now have to come up with $1,000 a month to make your car payments. To be fair, if you pay cash for the car, you must then also invest $1,000 a month at the same 8% return on investment.

We will need to add back the $1,800 for the cash discount. We will also tax the earnings in both accounts at 40%, since you should already be maxing out your retirement accounts and won’t have them available to use. We will only look at the investment portion of the deal.

When you purchase the car with cash, they give you a 5% discount so your investment account starts with $1,800. This initial deposit plus the 36 monthly deposits of $1,000 earn a total of $5,021.98 in interest, of which you pay $2,008.79 in tax, leaving your investment account with $40,813.19.

When you take the 0% car loan and instead invest the $36,000 at 8%, you will have made $9,728.53 in interest over the 3 years. You will pay $3,891.41 in taxes, leaving the account with a balance of $41,837.12.

The money you made for your efforts amounts to $1,023.93 over 3 years or $341.31 per year. That is a far cry from the initial estimate you might make of a $9,728.53 profit by taking the loan and investing the difference. But as always, when you get all the costs in place, things aren’t as they seem.

If you instead received an 8% discount by paying cash, all the profit from this deal is gone, negated by the cash discount, and making paying off the car the better deal. If the investment doesn’t perform as you expect, it could even cost you money to take the 0% loan and invest the difference.

Be sure to do the math before assuming you are getting a killer deal. Don’t forget about the hassle factor of the 0% loan; filling out the loan application, getting a credit check, having the loan company be the payee on your insurance, having another debt to put your financial status at greater risk, and being upside down with the car loan since you will owe more than it is worth once you drive it off the lot. I don’t think $1,000 spread out over three years is worth the anxiety or the risk.

I once took a similar deal on a car. I went in with the money to pay $36,000 in cash and then they offered me a 0% loan that I wasn’t expecting. I went home to figure out the math. I had a place to invest the money for a guaranteed non-taxable return of 8% and the dealer was not offering much of a cash discount. When I did the math, taking the 0% loan and investing the money calculated a significantly higher return, so I went for it. But it doesn’t always pencil out a winner. Make sure you do the math before jumping into a no interest loan as it could turn out to be a wolf in sheep’s clothing.

Read more about the consequences of debt in The Doctors Guide to Eliminating Debt.

Thank you for working through the math on this. Most people (self included) do not usually go through the exercise.

I’m curious though. You mention a guaranteed non-taxable return of 8%. What investment was this?

I had a loan on a piece of investment property that was costing me 8% interest. Paying off the loan, which was almost exactly the amount of the car, saved me the 8%. That savings would not be taxed as income. I took the 0% loan for the car and paid off the land. If we get technical, I was getting some write off for the interest I was paying, so my realized benefit was less than 8%. Since they were not offering me much of a cash discount, and the spread on the interest was good, I made a profit. But I did go home and think it through and pencil it out before pulling the trigger on the deal.