The real estate investor’s biggest fear is buying at the top of the market. Almost daily, I encounter someone asking if it is a good time to buy real estate with the current high market prices. This is a disguised way of asking “Should I be trying to time the real estate market?”

Never try to time the market, because you can’t. No one, not even the professionals, have been able to successfully time the market on a consistent basis. If the professionals can’t do it, then neither can you. Just remember this: It is always a good time to buy investment real estate.

Speculators are the ones trying to time the market. They are short term thinkers. Speculating is not investing. Investors are long term thinkers and they buy property with the intent to keep it for the rest of their lives. I want you to be a real estate investor, not a speculator.

Since you will not be trying to time the market and since you will be holding your property for decades, the current peak of the market is not relevant to your purchase.

Let me tell you about an experience I had with buying a property at the peak of the market in 2007. This is an example of the worst-case scenario.

The 2000s were a time of incredible real estate profits. Everyone was making money in real estate. Because prices were rising at double digit rates each year, people were buying property sight unseen and reaping the profits. They would buy, hold for a year or two and sell for a profit. Those were good times for speculators. (You are not one of them!)

I had been doing well with real estate, and I wanted my family members to see the value of investing in real estate. I convinced some of them to partner with me so I could show them how.

We set up an LLC. Each member contributed money for a down payment on a property and we each owned a percentage based on our contribution. Since I was already managing properties, everyone agreed that I would run the LLC and manage the property.

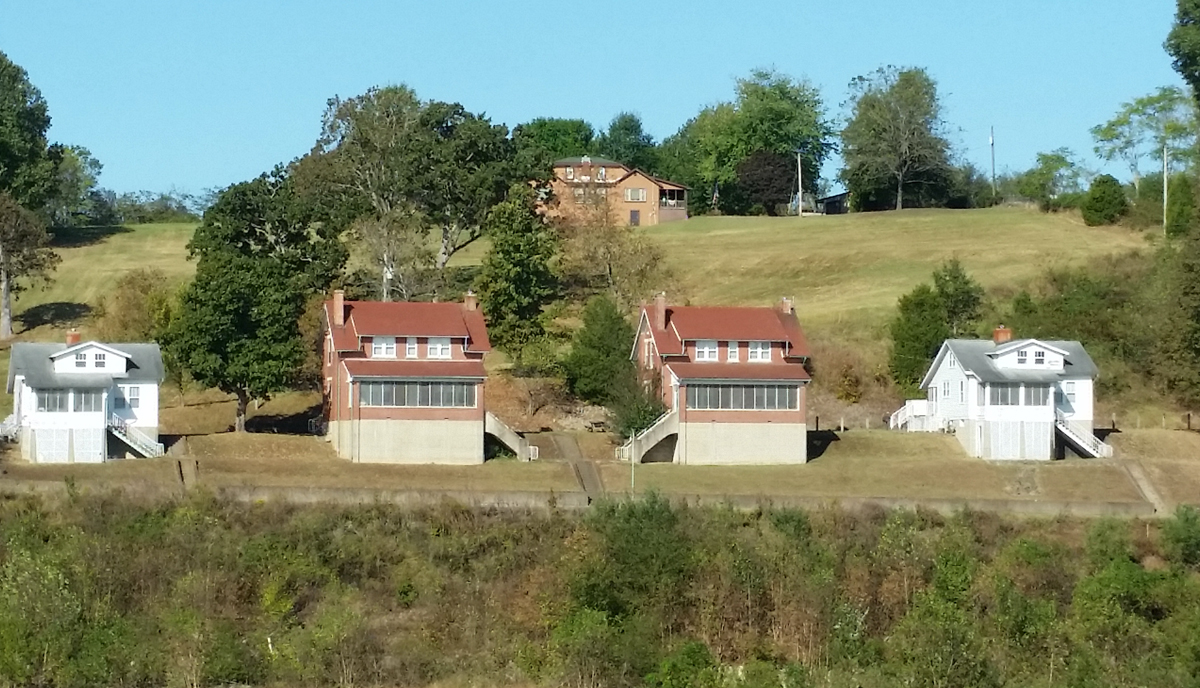

We found a nine-unit apartment and bought it for $595,000 in 2007. We put $145,000 down and the seller carried the mortgage. The cash flow was positive, but the building needed some fixing. Our plan was to fix the property, keep it for five years, and then sell it for a handsome profit, assuming the hot market continued. We paid current market price with a discount to account for the needed repairs. Both the seller and the partners thought we got a fair deal making it a win-win transaction.

It is important to note that we were initially behaving as speculators; buying for a short period and wishing to sell for a profit.

So we bought the place and started our adventure. A few months later, our worst fear was realized when the real estate market collapsed.

One of the partners panicked with the collapse and wanted out before it got worse. The rest of us were unwilling to sell the property for a loss. We bought that partner out at a discount based on the current depressed market value. Both sides of the deal were happy. He got out of what he perceived as a market meltdown before it hit bottom and we got a greater share of ownership at a discount. He panicked and lost money on the deal.

Over the first few years of this real estate meltdown, many properties went into foreclosure. Many real estate speculators lost their shirts. I know of one who committed suicide because his losses were so big.

Many people thought I was making a mistake by not buying more real estate at these “bargain” prices. But I don’t buy real estate based on the market and I had already met my real estate goals so I haven’t purchased anymore property. It turns out I would have made good money in hindsight if I bought more, but since it didn’t fit into my overall plan, I wasn’t buying. I already had enough.

Apartment owners were not effected as badly as the single-family-home owners when the market dropped. This is because apartment building values are based on rental income and single-family home values are based more on emotion. The real market value on the assessor’s books for our property fell to the value of the mortgage. At that point, we would have lost our down payment money if we had sold.

I had an interesting conversation with the past owner of that apartment building, who held the mortgage. He had been bragging to me about how he gave his home back to the bank. He purchased a nice house on the river for about a million dollars. During the market fall the house value dropped below the amount of his mortgage. So he gave his house to the bank and walked away.

He bragged about his poor financial decision as if he were a genius. It ruined his credit and he had to buy his next home in his son’s name because he couldn’t get a loan.

One day while talking to him I hinted that we were going to give him the property back, since the value had fallen to less than what we owed him. After all, he had told me that was the smart thing to do. You should have seen the look on his face. He thought he made a killing selling right before the market drop. Now he was going to get the property back and it might continue to drop in value.

Funny how he didn’t think that giving underwater property back to the lender was OK when he was on the other end of the deal. We never actually thought about giving the property back to him, but it was fun to see him squirm with a little of his own medicine.

I believe in win-win deals and giving his property back to him would not have benefited either of us. It would have been a lose-lose deal. We would lose money selling it for a loss and he would get a property back he didn’t want at a time he couldn’t sell it for a profitable price.

Since we bought the property with a positive cash flow, and the cash flow stayed positive throughout the market drop, we didn’t lose anything. We had a paper lose, due to the decrease in the property’s value. But there was no actual loss since we didn’t sell. We collected rent and made our mortgage payments as usual.

When the originally planned sell date came, the property was still worth less than our purchase price. We were not about to sell it for a loss when it was bringing in enough money to cover its expenses. We chose to hold on to it and lengthened our five-year plan. We transformed from speculators to investors.

In 2018, the value of the property increased enough for us to sell it for a profit. We put the place on the market and sold it for $779,500. This was 12 years after its purchase.

We bought it at the peak of the market, so it was the worst-case scenario for a speculative investment.

I more than doubled my money and with the final accounting, my return was the equivalent of putting my investment in an interest-bearing account at about 7.5% interest. So even in the worst case, the investment turned out well because we were willing to ride out the market changes by changing our plan from short term to long term.

Over the long haul, the direction of the market at the time you purchase a property will have little effect on your overall investment return. It is the appreciation over a long period of time that will make up for the little fluctuations.

The market will always go up and down. You will always be wondering where it will go next. The debate at the water cooler will continue. Are we at the peak or trough of the current swing? And in the long run, it is all irrelevant, the market goes up. For the real estate investor, these issues don’t matter. Only the short-term speculator will be worried about the current market condition.

“Don’t wait to buy land. Buy land and wait.”

—Will Rogers

We would have done even better if we continued to wait and held the property even longer. But it was a partnership and some of the partners wished to cash out. Had I owned the property without partners, I would still own it today and the value would be even greater.

Time smooths out market peaks and troughs. If you become a real estate investor, not a speculator, then the current market will always be irrelevant. All you want to do is buy property that yields a positive cash flow, put it into your portfolio, and enjoy the many years of positive cash flow and appreciation.

When you look back 30-40 years, you will wish you could have purchased at those prices. Thirty years from now, the current peak market will not look like a peak market, it will look like you bought the place at a bargain price. When prices are climbing, every day seems like a peak market.

Don’t wait for the low market bargains. Buy good cash flow producing real estate and hold on to it for life, no matter how the current market conditions make you feel.

For more information check out my book The Doctors Guide to Real Estate Investing for Busy Professionals. When buying your first property, or anytime your real estate investment feels like a second job, check out my online course, The Doctors Course to Automating Your Real Estate Investments so your real estate will always be an investment, not a second job.

Just to be clear, as I write this article, my wife and I are in our motorhome on a cross country trip. We are currently visiting Glacier National Park with spotty internet and cell phone service. We will be attending a play tonight and drove the Going to the Sun road yesterday. My 55 rental units are faithfully putting money in the bank for us as we travel. That is a good description of passive income, which is what your real estate investments should be providing.