As 2021 draws to a close, and we start thinking about beginning the new year with a fresh start, we think about making New Year’s resolutions. Although we plan to achieve these resolutions during the year, often by the end of January we have reverted back to our old ways. Resolutions long forgotten. But not this year!

If we get in the habit of utilizing our time the way high performers use their time, by doing things promptly instead of putting them on a list to do later, we will accomplish more. So, this year commit to completing the following list in the first couple weeks of January and make 2022 a year of action. If you have a problem following through with the goals you set, read this link about the secret sauce of goal achievement.

The following list is ways to help you start the New Year with a bang. Let’s see how many you can do by February 1st.

1: Increase your monthly 401(k) deposit, or whatever work retirement plan you have. This will automate your savings while giving you a tax break. When the money is automatically withdrawn from your paycheck, you will likely not miss it and the money saved over the years will create a nice nest egg. If you are self-employed and don’t yet have a retirement plan, don’t let January end without setting one up.

2: Fund an IRA account for you and your spouse. In 2022, you can each deposit $6,000 into your IRA accounts and an extra $1,000 if you are age 50 or older. Fund it the first week of January and be done for the year. Depending on your income level, this can best be accomplished with a traditional IRA (Get a tax break now with tax deferred growth), Roth IRA (No tax break now but growth is never taxed), or a back-door Roth IRA for those who don’t qualify for a Roth IRA (No tax break now but growth is never taxed). Congress is currently contemplating making changes to the IRA system. Start the year with the current rules; don’t delay thinking the rules might change.

3: Make payroll tax withholding adjustments. If you got a big tax refund in 2021 or had a large amount of taxes to pay, then adjust your payroll deductions so the amount of taxes withheld will be closer to the actual amount owed. Your best bet is to have the same amount withheld from every paycheck and end up owing nothing additional at the end of the year. If you have a variable income, or a rapidly rising income, then set up your payroll deductions for taxes to comply with safe harbor rules so you will not owe penalties for underpayment. If your adjusted gross income is less than $150,000 then pay the same amount as you owed last year. If your adjusted gross income is greater than $150,000, then pay 110% of last year’s taxes. Divide these withholdings evenly throughout the year.

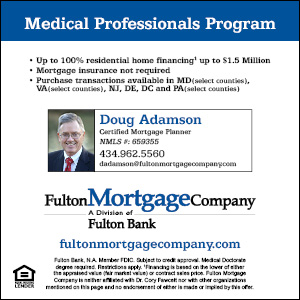

4: Refinance your loans. If interest rates are down a point or two since you acquired a particular loan, refinance the loan and save on interest. You will only need to do this paperwork once to reap the benefits from the savings for the life of the loan. If you have student loans that are about to come out of deferment, set up your action plan to eliminate them. Continue with PSLF or refinance and pay them off quickly.

5: Buy and read a book on finances. There is no time like the present to read a good book that will improve your life. If you don’t know where to start, read one of mine. You may already have a good book on your shelf that you bought but haven’t yet read. Start reading it tonight.

6: Fund your HSA. If you have a high deductible medical insurance plan, you likely qualify to have a Health Savings Account (HSA). The maximum contribution in 2022 is $3,650 for an individual and $7,300 for a family. You get a tax write off now when money is put into the account, it grows tax free, and when you spend it later, on healthcare, there is no tax owed. So, contribute to the fund this year, and every year, but don’t spend any of it until you have retired.

7: Start or fund a 529 college savings plan for each of your kids. Many parents want to help their kids pay for college. If you are debt free, make good money, live within your means, and save a lot, paying for college will not be a problem. If you do not fall into that profile, then a college savings plan might be for you. There is no immediate tax write off, but the account grows and gets spent tax free if the funds are used for education. You might even consider making a deposit into a 529 for a grandchild.

8: Increase your giving. Why not bump it up this year? 2021 was tough for many organizations so they could use an extra boost at the beginning of the year. If your goal is to tithe to your church (give 10% of your income) now is a great time to start. If you can’t afford to tithe right now, then start with less, maybe 2%, and work your way up. Many people say they want to give more, but they never get around to starting. Now is the time to make a change.

9: Make or update your will. This is another task we tend to put off. We naturally think death is a long way off. Unfortunately, many people die unprepared. If you don’t have a will, get it done before the end of January. If you have a will and it hasn’t been updated in over 5 years, re-read it and see if alterations are needed. If you have had another child since you wrote the will, they may need to be added.

10: Get a coach to help you change your life. Back in 2006, when I wanted to make some changes in my life, I realized that the only time I made major life changes was when I had a coach. There were many times in the past when a coach helped me advance. Find a coach that specializes in the kind of changes you wish to make. Fitness trainers, financial advisors, motivational consultants are just a few areas that have coaches available. If you don’t know where to start, I have a few openings in my schedule this winter to accommodate clients in my one-on-one Certified High Performance Coaching program. If you would like to be considered for one of the slots, contact me at MD@FinancialSuccessMD.com and we can get started with a free session. If you need financial coaching, then my one-on-one Total Financial Makeover may be right for you.

Now you have ten ways to change your life for the better in 2022. Even if you only do one of them, you will make a positive impact on your future. Each additional item on the list you execute will create even better results. Make 2022 your best year ever. Please contact me if there is any way that I can be of further assistance to you.

Have a great 2022!