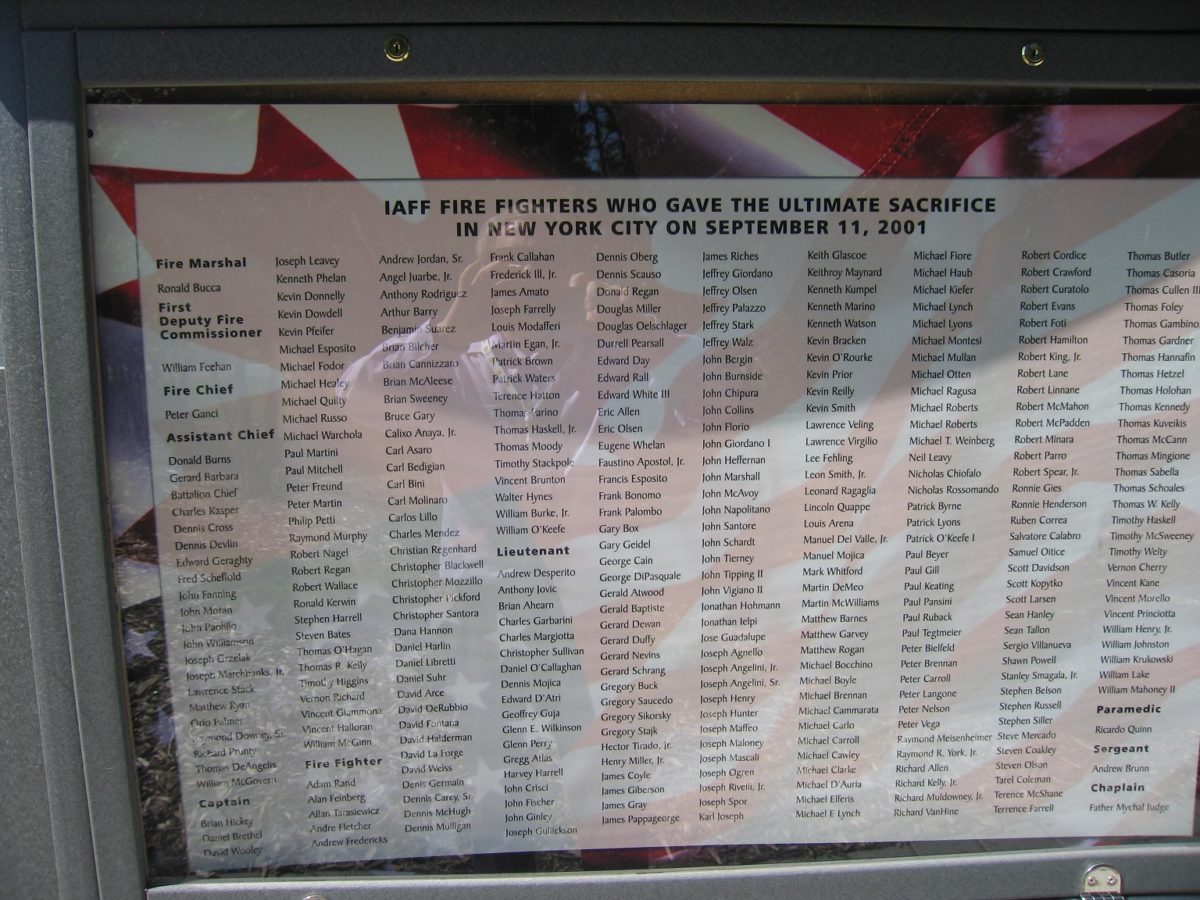

Firefighters Lost on 9-11

I was recently asked the following question: When is the right time to cancel a life insurance policy? Previously I wrote a blog about how to calculate the right amount of life insurance to purchase. You can read it here. This information is also found in my book “The Doctors Guide to Starting Your Practice Right.” So the issue of when to cancel the policy is a good follow up topic.

First of all, I hope you have heeded my advice and are interested in the cancellation of a term life insurance policy. You should either have a multi-year policy, mine was a 20 year level term policy, or an annual renewable term policy. If you have any sort of policy that includes investments (Whole Life) you will have a much more complex decision to make. For now let’s limit the discussion to when you no longer need a term life insurance policy.

Life insurance should be used to financially protect family members who are dependent on your income in the event of your death. If you have a home mortgage or other debts, a non-working or low income earning spouse, or dependent children, then you should have life insurance. Conversely, once those issues are no longer in play, you no longer need the policy.

For most families, this time comes when you pass the point of financial independence, or what I refer to in my books as the finish line. The finish line is that point where you have enough savings and passive income to cover all your living expenses. Once you cross that line, you are self-insured, and usually no longer need life insurance. After that, if you were to die, ending your income production, your family has enough coming in to cover all their living expenses and will not need any life insurance payout to stay in the black.

When that time came for me, I had several thoughts influencing me to keep my policy in force. It was such a small payment for such a big return if I were to die. The 20 year term of my policy was not finished yet. I’ve had it for so long there was some separation anxiety. The future was unknown so I was hesitant to pull the trigger.

I understand how hard it is to let it go, since I struggled with that when my time came. But you need to let it go, as I did. You no longer need the insurance and the payments will begin to climb in the near future making it even less palatable. There are better places to put your money than in an insurance policy you don’t need. You should never think of life insurance as an investment to enrich your family. It is only there to protect them, and they no longer need the protection.

There are criteria that you use to determine when it is prudent to buy the first life insurance policy and there are criteria for cancelling as well. It would not have been prudent to pay for a policy before it was needed; like when you were young and single and no one depended on your income. Even though the policy would be cheap, the fact that you don’t need it makes it prohibitively expensive. No matter how good the deal is, buying something you don’t need is still a waste of money.

This issue reminds me of the joke about coming home from the store with a bunch of merchandise you don’t need that was purchased simply because it was on sale and was a bargain. That’s when you say to your spouse, “Look how much we saved.” But since you didn’t need the stuff, and your bank account shrunk, you didn’t save anything. Your spouse should be saying, “show me the money you saved.”

There are other scenarios that would signal that you no longer need life insurance. For example, if you get divorced at an older age, and no longer have dependent children. Even if you have not crossed the finish line, no one is dependent on your income in that setting, so you don’t need life insurance. You should think about canceling it at that point. Consider what would happen with and without the policy. If nothing bad happens without a life insurance policy, don’t waste your money on one.

A related issue is the need for less insurance as your wealth accumulates. With term life insurance, it will be coming up for renewal at the end of each term. At that time, don’t just renew the same policy. Take the time to recalculate your current need. You may need more or less insurance at that point. Always have the right amount. More than you need is a waste of money on insurance premiums. Less than you need puts your family at risk. Think back to the children’s story of the three bears and seek the amount that is ‘just right.’

Other issues surrounding what to do when you cross the finish line are discussed in my latest book, “The Doctors Guide to Smart Career Alternatives and Retirement.” You can find it on Amazon. As always, if you are not sure how to improve your personal finances, contact me to discuss a one-on-one personal finance makeover. It is often easier to do with unbiased help. If you have any great insurance stories, I’d love to hear your comments.