When I retired, one of the dreads I faced was the need to pay quarterly taxes. After I retired from my medical practice and was a locum tenens doctor working through my private corporation receiving a 1099 each year, I had to file quarterly payroll taxes, even though I had no employees. I do understand that filing quarterly payroll tax is more cumbersome than making quarterly income tax payments but paying quarterly taxes is still a pain and when I stopped working in medicine, I wanted to avoid it going forward. I love automation and having less work to do.

Unfortunately, when you inquire about paying taxes in retirement, you are usually told that once you don’t have a W-2 job, where taxes are withheld from each paycheck, you must start making quarterly tax payments. You rarely hear that paying quarterly taxes is only one of the options you have.

One of the biggest problems with quarterly tax payments is figuring out how much to pay, because if you are wrong, you might owe interest and penalties on the underpayment. I know several people who got a windfall in the last quarter of the year, such as selling an appreciated property, who forgot to increase their fourth quarter estimated tax payment accordingly and were hit with interest and penalties for not paying enough quarterly taxes.

The other problem for many retirees is remembering to pay the quarterly payment during retirement travels, since the payments don’t actually fall on the quarter. If I was on a cruise off the coast of Brazil when I realize my quarterly taxes were due the next day, and I had no way of making the payment, it ruined my mood on vacation. The payment would be late and I would face the consequences of added penalties and interest.

I have been using an alternative method to pay my taxes for years so that I don’t have to file/pay quarterly tax estimates, and I never have to pay penalties if I underpaid the amount owned for the year. Not even a windfall late in the year will cause any trouble for me, even if I don’t send any extra taxes in for the windfall.

There are two IRS rules that come into play allowing wealthy retired people to never have to pay quarterly taxes or underpayment penalties.

The first rule you need to know is there is an alternative to the notion that anyone not getting a W-2 must pay quarterly taxes. It turns out that ANY form of receiving income that can have taxes withheld will work just the same as tax withholding on a W-2 paycheck. This includes money we take from retirement accounts.

I started saving my retirement funds in a traditional IRA back in the 1980s as a surgical intern. When I take a distribution from my IRA, the institution holding my funds asks me how much state and federal tax I wish to have withheld. Because I pay my taxes through withholding on each IRA distribution, I don’t have to file/pay quarterly tax estimates. The IRA withholding functions the same as W-2 withholding.

Another interesting thing to remember is the IRS deems that withheld taxes are considered to have been paid evenly throughout the year. Applying this rule means I can take one annual IRA distribution every December and have my entire year’s tax obligation withheld from that distribution. I can make a few mouse clicks and my distribution is divided into three portions: Federal Tax withholding, State Tax withholding, and a deposit to my checking account. This method of paying my taxes completely eliminates the need for me to pay quarterly tax estimates. It also allows me to keep my funds invested for the entire year before paying taxes.

The next rule that comes into play is the concept of paying taxes at the “safe harbor” amount to avoid penalties. The safe harbor rule was designed to help business owners with a variable income not have to pay penalties if they try their best to pay the right amount of tax, yet still miss the mark. I paid my taxes during my working years using the safe harbor method because in private practice, I never knew what my income for the year would be until the year ended.

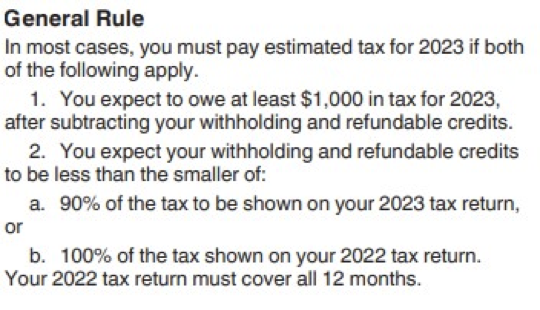

If you pay the safe harbor amount through withholding, no penalties will be charged if you are wrong. The safe harbor amount to pay is based off either this year’s tax liability (an unknown amount) or last year’s tax liability (a known amount). You must pay using one of these methods.

1: Pay at least 90% of the taxes owed for the current tax year.

OR

2: Pay 100% of last year’s tax liability if your adjusted gross income last year was $150,000 or less for those married filing jointly ($75,000 if single). If your adjusted gross income last year was greater than this threshold for your filing status, then you must pay 110% of last year’s tax liability to be in “safe harbor.”

Since I am retired, and have a variable income from real estate, speaking, coaching, and book sales, I never actually know what my adjusted gross income will be until the year ends. Therefore, I always pay 110% of last year’s tax liability. Then no matter how much I make for the year, I will not owe penalties even if I underpaid my taxes. But if you can accurately estimate your taxes in December, so you know what you will owe, you can use the first rule and pay at least 90% of that year’s tax liability. I have never used the current year calculation method as I don’t want to risk miscalculating it in December.

Let’s look at an example of how I apply this to never pay quarterly taxes and never owe a penalty for underpayment of taxes.

Let’s say that last year my adjusted gross income was $200,000 (line 11 on form 1040 in 2022) and my federal total taxes owed came to $40,000 (Line 24 on form 1040 in 2022) and my state total taxes owed came to $18,000. The safe harbor rule would have me pay 110% of last year’s tax liability in order to not risk paying a penalty if I had a higher income this year.

I simply need to have $44,000 federal taxes and $19,800 state taxes withheld from my IRA distribution to fully satisfy my tax paying requirements during the year.

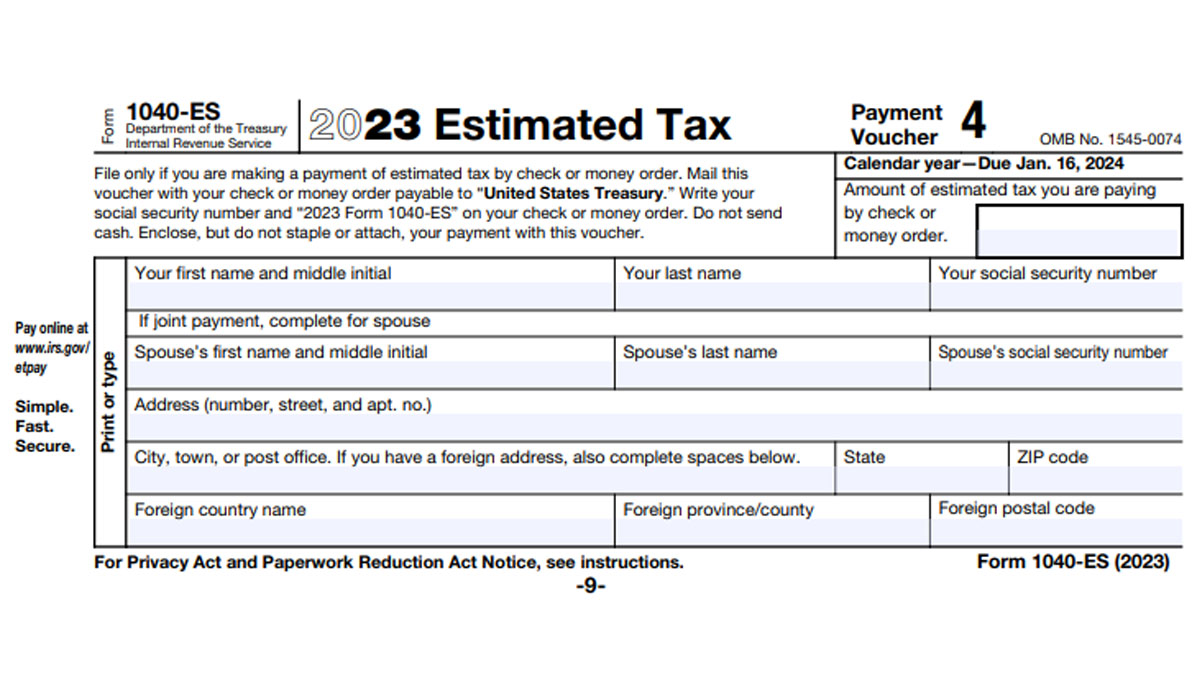

Let’s say I want to take a $100,000 distribution from my Traditional IRA this year. I would log onto the brokerage account holding my IRA and inform them I wish to take a $100,000 distribution. Before starting I must be sure I have that much money sitting in cash. If I don’t have enough cash in my account, I must sell something to generate the needed cash. Since I invest in mutual funds, there is a slight delay in having the funds available when I decide to sell.

When I request a distribution, I am asked how much tax I wish to have withheld. With my account, I must answer this question as a percentage of the distribution rather than a dollar amount. I would tell them to withhold from the distribution 44% for federal taxes and 19.8% for state taxes. They will then take care of sending in the taxes and the balance will be deposited into my checking account.

I can log into my brokerage account a few days later and confirm I had $44,000 withheld and paid to the IRS, $19,800 withheld and paid to my state department of revenue, and the remaining $36,200 deposited into my checking account.

Since I paid the safe harbor amount through withholding, no matter how much I earn and owe this year I will not incur any penalties. Next year in April, when my CPA tells me the actual amount I owe for the prior tax year, I will either pay an additional amount when filing my taxes or get a refund. I will then use that new total tax owed number from my tax form to calculate the next year’s withholding when I do my IRA distribution in December.

Below is a screenshot of the rule from the instructions for 2023 IRS form 1040-ES. Translating this rule it says if you have tax withholdings that meet the safe harbor numbers, you don’t need to pay quarterly estimated taxes.

This method will work using any source of money you receive from any entity that has the ability to withhold taxes.

I have loved not needing to file quarterly tax payments and never getting tagged with a penalty if I guessed the wrong amount to send in for the year. A few mouse clicks once a year is way easier than remembering to file the four quarterly tax payments.

Have any of you used this method to avoid quarterly tax payments during retirement?

I really don’t know anyone who’s entire portfolio is tied up in an IRA. Most of us have a variety of sources, and many of those pay dividends and/or have gains. So 99% of us will have to pay that quarterly estimate. And while they are due on a certain date you can pay them before that date. Lastly, it’s not hard for anyone who has these investments not to know what they’re going to pull out across the year.

I just checked and found out that Hawaii does not allow withholding taxes from RMDs, but will gladly tax your RMD income. You do know that Hawaii is a very progressive state.

Thanks for pointing that out. Hawaii is one of the stated that doesn’t have the ability to handle withholding taxes from self-funded retirement plans. (But they let some retirement money stay state tax free.) Every state makes different rules. You can still do withholds for your federal taxes from every state.

The devil is in the details. In this example he did a large distribution from his IRA. That is fine, but if you didn’t need it and you wanted it to continue to grow “tax deferred” that is not such a good idea. You can just on line pay all the “estimated taxes” at once or schedule them and the IRS will take the $ on the dates due directly. That is no harder and you don’t need to sell tax deferred assets. You need to set up an IRS account

Yes, you will add to your taxable income when the money comes from a tax deferred account. The best use of this method is for those of us who are already drawing from those types of accounts. Early retirees who are taking money from their IRAs through the SEPP plan and those taking RMDs are already taking their money and getting taxed for it. An extra mouse click and the withholding is taken care of. If you use the Quarterly Payment system and you sell some big asset in the fourth quarter and forget to pay extra taxes, you will get hit with a penalty. Quarterly payments do not follow the same rules as withholding.

What if you’re not yet taking IRA income or the account isn’t large enough to meet 110% of the prior year’s tax liability?

Can’t you just make ONE of the 4 typical deadline estimated tax payments for those exact same amounts as say in this Dr’s example (110% of prior year’s tax liability still)??

When you pay quarterly, the payments follow separate rules than withholdings do. You cannot, for example, make a onetime quarterly payment in the last quarter as you can with the single IRA distribution in December. Also if you forgot to send in the form on time you will be penalized in the quarterly system. I’m not sure if you can get away with paying all your taxes in the first quarter. When you are paying quarterly, they expect to get four payments, even if one of them is zero, you still send in the form.

This is a very good write-up and something simple to do that most people don’t think enough about. 2 income tax things I really try to avoid is owing underpayment penalty or getting an overpayment refund. I’ve found that the methods you have laid out do work to control both.

Excellent article a always . I’ve been using the safe harbor rule for decades.

Your point about about entities with the ability to withhold taxes is well taken. In addition to 401k and IRA I have a taxable brokerage account – they will not withhold any taxes.