In my recent book, The Doctors Guide to Real Estate Investing for Busy Professionals, I give a detailed explanation about how I was able to buy investment property with no money down. Questions came up about what is the optimum down payment for an investment property.

Since my goal in acquiring property was to put it into my portfolio for the least acquisition cost, I didn’t calculate its optimal down payment until now. Once it is in my portfolio, then all the profits and tax benefits begin to accumulate in my favor and will continue to do so for the rest of my life. Optimizing the down payment was not nearly as important as simply acquiring the asset. When you intend to keep the investment for life, the initial cash on cash return is not that important.

I took the actual income and expense from two of my properties; one that was purchased with no money down, meaning it had a positive cash flow with 100% financing, and one that required a down payment to make the cash flow positive. I asked my wife, who is a whiz with spreadsheets, to analyze the cash flow that would be generated from these two properties with various down payments. I was surprised by the results.

First, we should dispel the myth that more down payment makes an investment less risky. That is not the case. There are only two down payments without risk: 0%, which has no money at risk if something goes wrong, and 100%, which has no loan that could be foreclosed on.

Any amount of down payment between those two has a risk of you losing the property if the loan is foreclosed on. You would also lose any money you had put into the property. An 80% loan is really no more risky than a 70% loan.

The higher the down payment, the less chance you will be foreclosed on, but your loss will be greater if it happens. I’m not sure how one would quantify those two variables, but they do counteract each other.

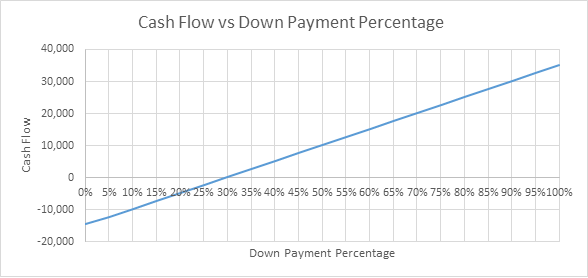

We looked at the following variables in relationship to the down payment: cash flow before and after taxes, and cash on cash return before and after taxes.

Looking at both of the properties, it became clear that if cash flow is your only goal, there is not an optimal amount of down payment required. The higher the down payment, the greater the cash flow, the relationship is linear.

Looking at these two charts you can see the first property could be safely purchased with any amount of down payment. The second property required a minimum of 30% down to acquire a positive cash flow, which is the only safe way to buy.

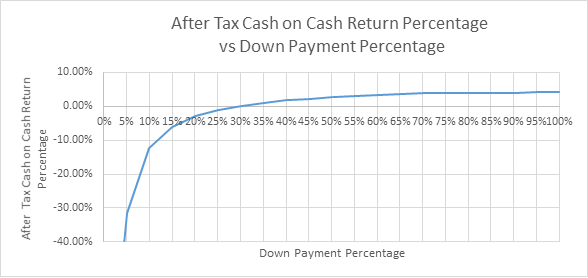

Next, we looked at the after tax cash on cash return in relationship to the down payment. Many people like to use the cash on cash return to decide if an investment is worthwhile to add to their portfolio. I don’t care about this factor when evaluating property. I look for long term profits, which come from growth, not short term cash on cash return. But if all other things are equal, you can use the higher cash on cash return property as a tie breaker for which property to purchase. Also, the cash on cash return is important is you are only keeping the property for a short time.

This graph is useful to answer our question about the optimal down payment. In both cases, once your down payment reached 30%-40%, you really were experiencing diminishing change as the line flattened out. At this point, the bigger your down payment, the smaller your return percentage will change, but just barely. An interesting note here: If a property can be purchased for no money down, a larger down payment will lower the return percentage and vice versa if the property requires a down payment to be cash flow positive.

With the first property, your cash on cash return is infinite when you put zero money into the investment and yield a positive return. That is a great place to be. Even though it is an infinite return percentage, the absolute number is small.

The second property has the opposite graph with an infinite negative return with zero down payment.

After studying these graphs, as well as the others I didn’t include here, I came to the following conclusions about these two properties. Keep in mind this is only about down payment and cash flow.

1: If a property has a positive cash flow with zero down payment, it is an exceptionally good investment with an infinite cash on cash return and a positive cash flow. Simply increase the down payment to achieve your desired cash flow.

2: Making a down payment greater than a third of the sales price doesn’t alter your return percentage much, but it will increase the actual cash flow. I suspect this is why most conventional financing requires a 30% down payment.

There you have it, the optimal return on your investments seems to be at a down payment of about one-third the purchase price. Keep in mind, I never recommend purchasing an investment property with a negative cash flow. You shouldn’t support investment properties with your other income sources, they should stand alone. You can own an infinite number of properties that have a positive cash flow. Find some investment property to put into your pocket and get started today and let me know how much you put down and why.

For more information on how to successfully evaluate, purchase and manage your own properties, pick up a copy of my best-selling book, The Doctors Guide to Real Estate Investing for Busy Professionals.

Interesting read. I enjoyed your book on real estate and would like to acquire my own apartment building much like you did. I’m finally in a position where I’m able to save over half of my income and I hope to throw the other half toward properties. I’m also trying to find the words to use for borrowing money from others for those larger down payments.

Zac if you are only living on half of your income and investing the rest in real estate, you are going to do very well. You will definitely reach Financial Success.