Do you own a small business or an LLC? If so, then you need to be aware of the new federal law that went into effect in 2024: The Corporate Transparency Act (CTA). With the advent of the Limited Liability Company (LLC), came the ability to hide behind a business wall. It became possible for someone to own a business without revealing who owns the business.

Someone could have an attorney set up an LLC in Oregon, owned by an LLC in Colorado, owned by an LLC in Delaware and so on. The owner’s name could be missing from each of the LLCs in this LLC chain. So, if someone wants to sue the LLC in Oregon, the LLC that is actually doing business, they would not be able to find the name of the person to sue.

The people who tout asset protection love these nested LLCs where they can become anonymous. Criminals love this also as they could start a company for illegal activities and if the company was caught, no one could find the person to arrest. So along comes the Corporate Transparency Act to stop criminals from hiding behind these LLCs. This new law requires every company to identify the beneficial owners of the company. The real people who own the company, not their attorney or representative.

All business owners must fill out a Beneficial Ownership Information Report (BOIR) with the Financial Crimes Enforcement Network (FinCEN) before the end of 2024 or face a very stiff $500 per day fine. Filing this report is not only easy to do, but it is also free. I completed five reports in one afternoon, which included researching what I needed to do, gathering the information needed, and entering the data into the online form. None of the information in this report will be available to the public.

Following is what you need to know to complete the task.

What is a beneficial owner?

Every company has someone in charge or someone who has the most to gain from its operation. There are two rules that determine who must be reported as a beneficial owner.

1: All company owners with a 25% or more share of the company.

2: The people who have “substantial control” of the company operations.

For example, I am on a four-person board that runs a real estate LLC. There is no owner who owns more than 25% of the company. So, rule number 1 does not apply. I reported the four board members as beneficial owners.

If the owner is a trust, then the trustees are listed as the beneficial owners.

The point is, real people either own a big share (a large financial benefit), or do the day-to-day operations (have “substantial control” such as a CEO, CFO, President, Manager, etc.).

The beneficial owners must be identified by name, street address (Not a PO Box), date of birth, driver’s license number (or other similar government picture ID such as a passport), and a copy of their ID must be attached to prove they are real.

Reporting Timeline

The Corporate Transparency Act was passed in 2021 as part of the National Defense Authorization Act. The government needs time between passing a new law and enforcing the law. They must set up the infrastructure, including a website to collect the application information, before they can enforce the new law. Thus, the Act was set to take effect in 2024.

If you form a new company in 2024, you have 90 days to register the Beneficial Ownership Information with the FinCEN. But if the company existed before 2024, you have until year end to submit the required information.

The penalty for not meeting the deadline is $500 for each day you are late. DON’T MISS THIS DEADLINE!

In the future, whenever any piece of information previously reported changes, such as getting a new board member or selling shares that will change who owns 25% or more of the company, the information must be updated within 30 days.

Exemptions

As is always the case, there are some exceptions to this reporting requirement. Here is the list of exemptions from the FinCEN website. It seems there are other rules that let the government know who is behind the types of companies on this list.

Information you must report

The hardest thing about filing this report was gathering the required information. Once you have all the required information including copies of everyone’s ID, filling out the form is very easy. It took me less than 10 minutes for each company.

You will need the following information:

1: Official name of the company as reported originally to the state, along with any other names the company uses such as trade names or names you do business as (DBA).

2: The Company’s Taxpayer Identification Number (TIN). This is either a person’s Social Security Number or an Employer Identification Number (EIN). Both numbers are nine digits long.

3: The company address and the state in which it was formed.

4: The identifying information for the company applicant, if the company was formed in 2024. This includes their name, street address, date of birth, and a copy of their ID. This section of the report is skipped if the company was already in existence before 2024.

5: The identifying information of all the beneficial owners of the company. This includes their name, street address, date of birth, and a copy of their ID. Obtaining a copy of everyone’s driver’s license was the most cumbersome aspect of collecting the information. I had each person take a photo of their license with their phone and text or email it to me.

6: The identifying information of the person submitting the form which includes their name and email address.

Filling out the form

Once all the data is gathered, you are ready to fill out the BOIR form on the FinCEN website. Click here to get to the form.

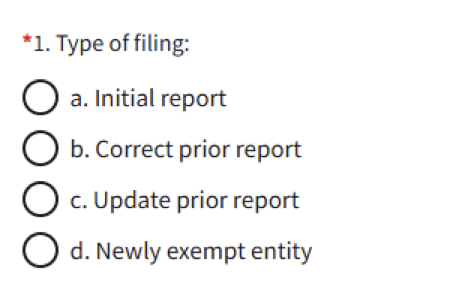

The first page is simply to identify what type of information you will be supplying. Most likely you will be using “a. Initial report.”

Click the “next” box on the bottom right after every page is complete to go to the next page.

The second page is the company information. They will first ask if you want to receive a FinCEN ID. I only did this for the one company with lots of members, in case someone asked. I think having this number is designed to speed up the filing if you need to report a lot of companies. Your FinCEN ID can be used to prefill pages on the subsequent reports you submit. I never used that feature. You will need to input the company name, the taxpayer identification number, and address.

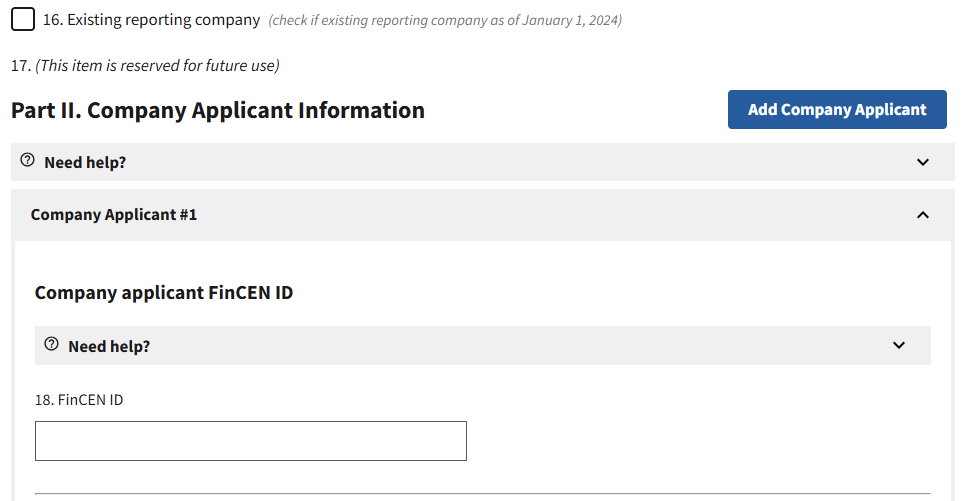

The third page identifies the company applicant.

If your company existed before 2024, then click box 16 and go to the next page. If this is a new company formed in 2024, then you will fill out the information identifying the person who applied for the company formation. This will include their name, street address, date of birth, and a photo of their ID. You will upload a copy of the identifying person’s ID on this page. If you already have a FinCEN ID, you can put it in box 18 and it will prefill your information onto the form.

Hint: Once you have a copy of everyone’s driver’s license, you have all the identifying information you will need on that person to fill out the form.

Page four is used to identify all the beneficial owners of the business. After filling in all the identifying information previously discussed for a beneficial owner and attaching a photo of their ID, then go back to the top of the page and click the box in the top right to “Add Beneficial Owner” to input the information for the next owner. Repeat this until all the owners are identified before clicking on the “next” button at the bottom right of the page. If you forget to add a person before hitting “next,” there is also a “previous” button on the bottom left of each page so you can go back and add the BOI you missed.

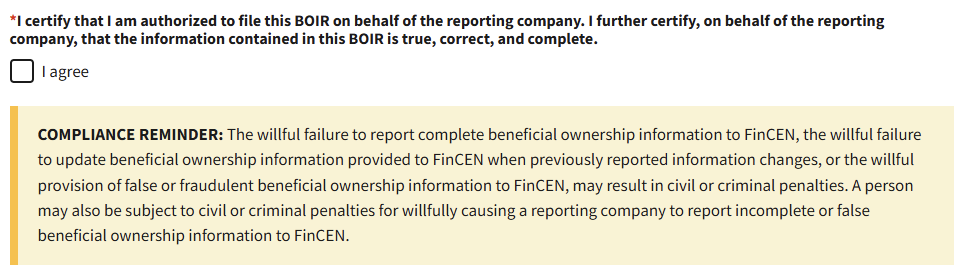

The fifth and final page identifies the person who filled out this form. This includes your email and first and last name. You will also certify that you have the authority to fill out the form and will be reminded about the consequences of lying.

When you are sure you have finished everything, you will click “Submit BOIR” on the bottom left of the last page.

Once you have clicked “Submit BOIR”, you must wait up to two minutes for the submission to be completed. You will then get the notice “Submission Status Confirmation” to let you know it has been successfully submitted. Then click on “Download Transcript” in the top right of the page. Save a copy of what you reported for your records. If anyone contacts you for not completing your BOIR, you now have proof of its completion. I also received an email the next day notifying me that the process was successfully completed.

If you own or are a part owner of a small business or LLC, make sure this report gets completed. In the future, if any of the information changes, you are required to update it within 30 days of the change, checking the “c. Update prior report” box on the first page. There is also a stiff penalty for not doing the updates.

Congratulations, you have now completed the next installment of governmental bureaucracy that clutters our to-do lists.

There is a preliminary injunction in place that has suspended January 1, 2025, required filing deadline. Entities may voluntarily file the report if they so choose. The filing is relatively simple; I have already filed for my company.

Yes the courts are delaying the date the penalty for not reporting becomes effective. But we should all get the report done anyway. It will take more time to keep watch for when the end of our procrastination period becomes official than it will to take the 10 minutes to fill it out now. Fill it out now and then stop listening to the noise.

Thank you for the info.

Would you know if a PLLC is FORMED in one State and TRANSFERRED to another State which info is entered on the Beneficial Ownership Information form?

This is a federal form. They don’t care what state it is in.

is this required to be done every year?

No it is a one time thing. You do have to update it if the information changes.

Please note whether this applies to physicians in private practice.

If you registered your private practice then you need to fill it out. You are not on the list of exemptions. If you are not sure, then be safe and fill it out. It only takes about 10 minutes. If you are the only owner, you won’t need to look elsewhere to gather the information needed.

Is this a requirement if you are a PSC?

If your business is registered with the state then you will need to fill it out unless you are on the exempt list.

Thanks for the heads up, this is something I may have missed and would have been an expensive oversight, to say the least:)

Hi. Very helpful even with the instructions already being fairly decent. As always, appreciate the insite!